3rd September, 2021

Automatic QR codes and plenty of updates for MYOB Practice take centre stage in MYOB product updates for August.

The second half of the calendar year has already seen a host of updates and enhancements to MYOB products.

These include features to help you invoice and get paid faster, as well as significant improvements to MYOB’s Practice suite, aiming to help advisors become even more effective in delivering their services.

Below, we detail all the main changes made to MYOB software in August this year.

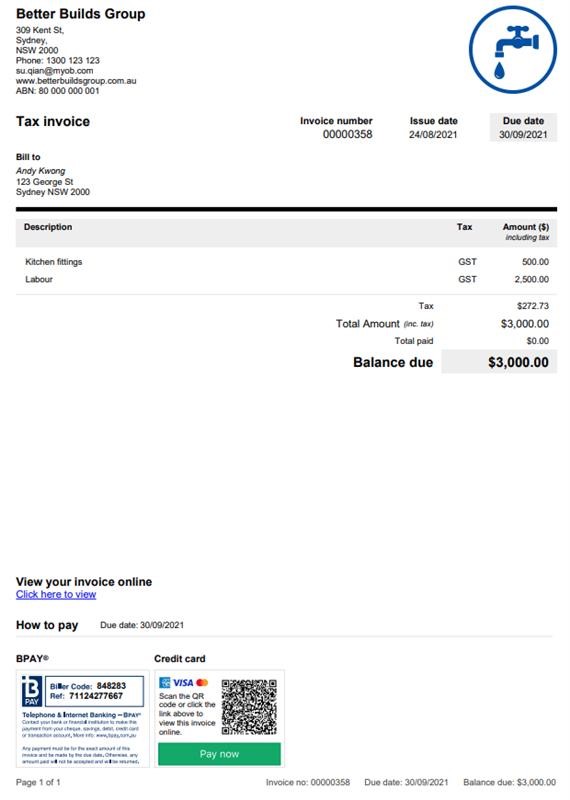

View (and pay)* online invoices with automatic QR codes

An automatically generated, unique QR code will now be displayed at the footer of invoices created within MYOB Essentials and AccountRight in the browser (standard invoice template only).

That means people can easily view and pay the invoices you send them, simply by scanning the QR code.

Benefits of using QR codes:

* Please note: QR code is not supported on customised AccountRight invoice templates).

A new tax workpaper is available to enter the PAYG instalments and HECS-HELP study loans. This data can also be pre-filled from the ATO report. Find out more here.

Key details:

In MYOB Practice, you can now pre-fill data using ATO reports.

By using the pre-fill data from the ATO, you can save time, and avoid errors that can happen with manual data entry.

Stay up to date with these and other releases in MYOB Practice here.

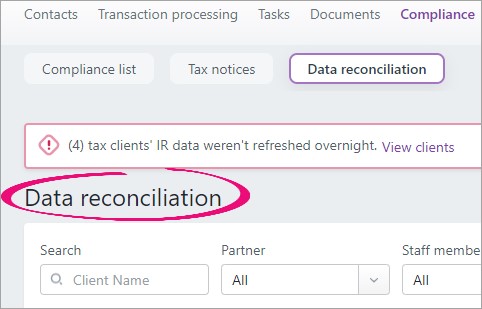

Improvements made to MYOB Practice in NZ mean that you can now see the Unreconciled transactions panel in Data reconciliation even when there are no currently unreconciled transactions. This means you can always access the Add MYOB transaction function. Learn more.

Also, in the Data reconciliation and Tax notices sections, wherever there were references to IRD in the user interface, these references are now displayed as IR.

We’ve added a Data reconciliation heading above the filters in the All clients view.

Advisors can now see their clients’ IRD number on the top right of MYOB Practice. This is convenient as a quick reference when working on data reconciliation, tax notices or tax returns.

The IRD number is displayed on any page when you select a client from the Contact list or client sidebar.

We’ve added a Delivery preference drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display tax notices that are set to Send manually, Send task to client, Send email to a specific client or All.

This is a useful filter to apply when selecting tax notices to send in bulk.

For tax notices that need to be sent manually and therefore can’t be sent in bulk, this filter lets you easily exclude them. It also allows you to see just those tax notices that you need to prepare for sending manually. Learn more here.

Now there’s an easier way to control which users can perform certain actions in MYOB Practice in bulk. See how it works here.

To catch all the detail regarding releases happening in MYOB Practice, click here.